does lowes accept tax exempt

In the store you can present your state tax exempt paperwork at the service desk and they will provide you with a tax exempt card that you will present to the cashier PRIOR to starting check-out for future purchases. If purchasing in-store you will need to provide our proof of exemptionsee below and a valid ID inside the store to set up a tax-exempt account.

As of January 5 2021 Form 1024-A applications for.

. Check out Best-Buy Tax-exemption. Wait for 10-15 business days to get processed by mail or receive instantly in the store. You cannot choose how and when to withdraw the tax exempt income it is paid out in proportion to your total holdings.

Once accepted you can continue selecting items as tax exempt and will be able to check out using the normal. An NTTC is the only documentation TRD can legally accept as documentation for certain deductions taken by sellers or lessors. In the event that you need to make a purchase thats taxable check the Remove Tax Exemption box at checkout to apply tax to the entire order.

Have your local Lowes store provide you with your Lowes Customer ID or Lowes Tax ID. - Answered by a verified Tax Professional. If a retailer chooses not to accept an exemption certificate from a purchaser on a qualifying exempt purchase a purchaser may request a refund of the tax.

Keep in mind this is a rough example and will change. Apply for Best Buy Tax-exempt Quick Card Program by mail or in-person. Export sales available on most products in stock at Lowes.

You will have to present your reseller certificate every time you want to make tax-exempt purchase. Let us know and well give you a tax exempt ID to use in our stores and online. View 35 new coupon codes discount codes to save big on appliances tools furniture and more.

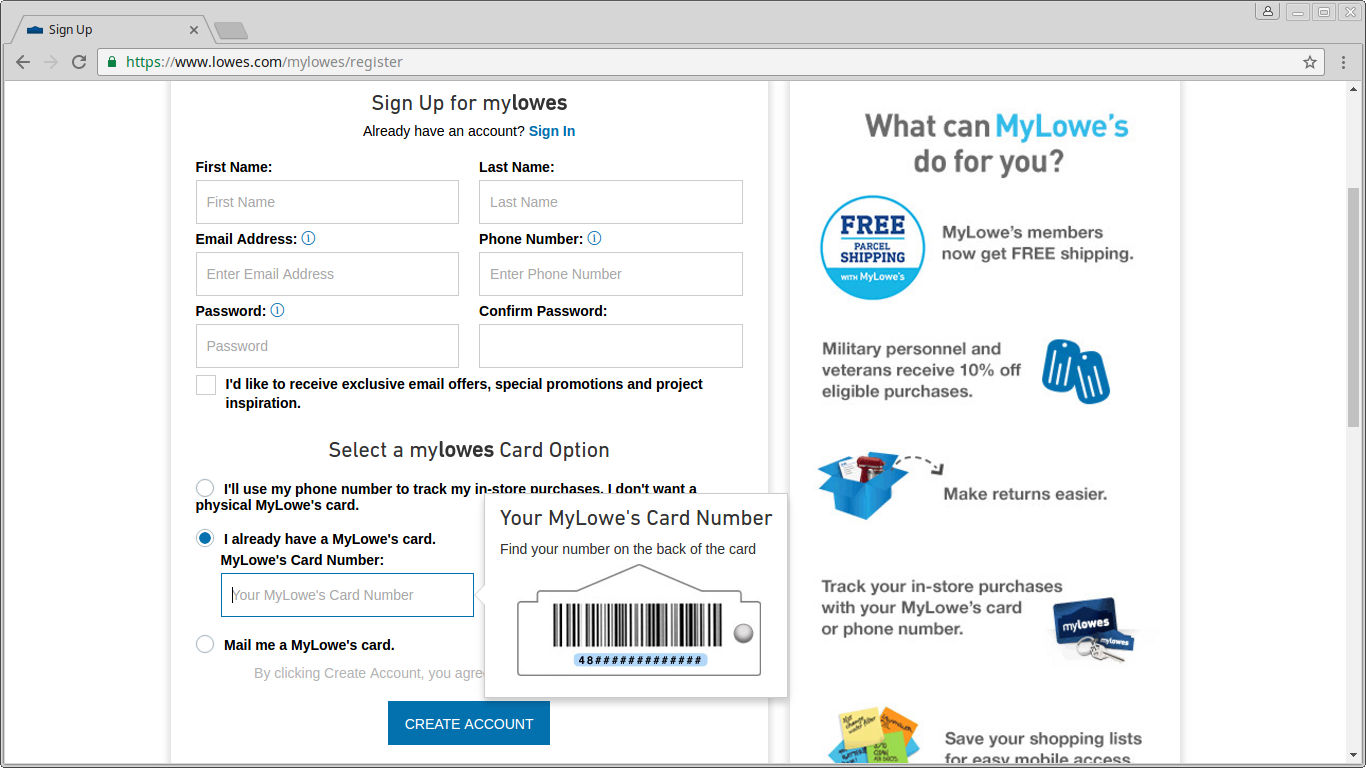

How do I register as tax-exempt. Tax-Exempt Management System TEMS Click Sign in or Register in the top right corner. Sign in with the business account you will be making tax exempt purchases with.

Trying to get sales tax exemption at Lowes. New Lowes coupons promo codes - 10 Off this April 2022. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want.

Drop personal containers and Lowes will load documenting the loading process. Tax Exempt Accounts Your organization must meet eligibility requirements as set forth by your state. Establish your tax exempt status.

TAX EXEMPT CUSTOMERS 1. Sales Tax Exemption Certificate Finance Resource Center 336-658-2121 Option 7 Special Order. As of January 31 2020 Form 1023 applications for recognition of exemption must be submitted electronically online at wwwpaygov.

Use your Home Depot tax exempt ID at checkout. Easily identifiable shipping labels. A purchase was made for a school by a person who used a different Tax Exempt other than our PTO.

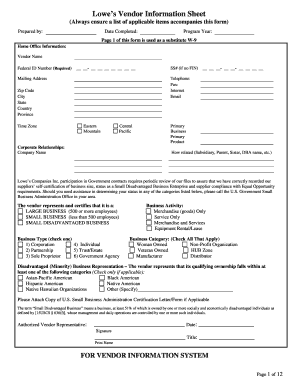

If you are interested in applying for tax-exempt status you must fill out the appropriate documentation for the state in which you are requesting tax-exempt then forward a copy to our office for review. We assumed that this was a no-no told the. Applying for Tax Exempt Status.

Walmart Tax Exempt Program. Target Tax-Exempt Account. All registrations are subject to review and approval based on state and local laws.

The law does not require a retailer to accept an exemption certificate. Click Organization and then click Tax Exemptions. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

For example if you have 100000 in your TSP and 10000 of that is tax exempt you would receive 90 of your withdrawal as taxable income and the other 10 as tax exempt. When each item is scanned there will be an option to select if the item is tax exempt or not. For information regarding this policy persons doing business or seeking to do.

In trying to set up our Treasurer Guidelines we ran across a situation that occurred last year. Once signed in click on My Account in the top right corner of the search bar. On 62410 at 941 pm.

Does Lowes accept tax exempt. Get a Lowes Tax-Exempt Management System TEMS ID online or register at the ProServices desk at your local store. To request a refund of sales tax paid on exempt purchases please contact customer service at 1-800-926-6299 to provide order information and details about your resale or exemption certificate or other valid proof of exempt status in.

As a 100 disabled vet living in Oklahoma and using the Tax exempt card issued by the State for the last 10 years had no problem using it however KEEP YOUR receipts Home depot has the same as Lowes however HD in Oklahoma when using card gives u 10vets of purchases and and sales tax exemption BUT have found Local lumber yards will be cheaper. Exemption numbers or exemption form if applicable We do not accept sales tax permits articles of incorporation tax licenses IRS determination letter unless required by state law W9s or certificate of registrations for enrollment into the program. Help with Scan Go.

What form should I get. Walmart has a separate program for online and in-store purchases. We use cookies to give you the best possible experience on our website.

To get started well just need your Home Depot tax exempt ID number. This was caught when they requested reimbursement. Of their immediate families should not request or accept gifts or other personal benefits from any of Lowes vendors or service providers.

After your first item is selected as tax exempt you will be prompted to agree to the tax exempt disclosure. If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number. Letter from Best Buy.

View or make changes to your tax exemption anytime. If your customer obtains an NTTC from TRD and executes it to you as seller or lessor you may exempt your customer from paying gross receipts tax. Will accept wire transfers and letters of credit as forms of tender.

Tracking Tax Exempt Purchases was created by Elmer. I thought everyone had to pay sales tax or at least show proof if making purchases for a non-profit. Lady in front of me at Target says Im tax exempt to the cashier before scanning her groceries.

A retailer may accept a properly completed exemption certificate in lieu of collecting tax on an exempt transaction. Cashier nods and says ok. Will palletize secure wrap and deliver your order to the freight forwarder or port of your choice.

Credit Exemption Home Improvement Neighbor Tax Home Improvement Exemption Tax C Home Improvement Show Home Improvement Tv Show Lowes Home Improvements

First Alert Am Fm Weather Band Clock Radio With Weather Alert Lowes Com Emergency Radio Radio Alarm Clock Digital Radio

Automate Your Lowe S In Store And Online Receipts

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance Tax Table Irs Taxes Tax Brackets

Automate Your Lowe S In Store And Online Receipts

Gojo 41 Fl Oz Antibacterial Foaming Hand Soap Lowes Com Foam Soap Clean Hands Foam Soap Dispenser

Mojo Licensing 19x13x8 Black Backpack Lowes Com Backpack With Wheels Backpacks Black Backpack

Lowe S Never Stop Improving Your Portfolio With This Dividend King Low Seeking Alpha Military Discounts New York Fashion Week Lowes

Tax Exempt Stores Who Honor The Tribal And Band Cards Posts Facebook

Diy Staircase Renovation Completed In 1 Weekend 4 Diy Staircase Renovations Home Improvement Show

Tax Exempt Stores Who Honor The Tribal And Band Cards Posts Facebook

Tax Credit Eligible Items At Lowes Com

How To Purchase From Lowes Uf Procurement Uf Procurement

Lowe S Targets Industry Pros With New Marketing Campaign Builder Magazine

Lowes W9 Fill Online Printable Fillable Blank Pdffiller

Lowe S Teachers Pay No Sales Tax With Tax Exempt Documents Teachers Customer Care 2nd Grade