can you look up a tax exempt certificate

Many of the expats do quite a bit of shopping when. It may also permit you to buy products from suppliersmanufacturers without paying sales tax on them.

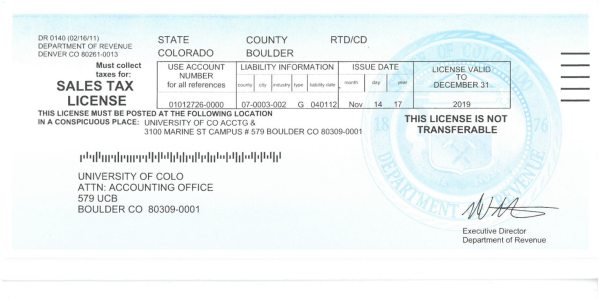

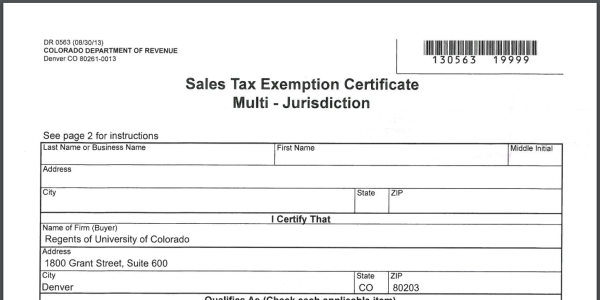

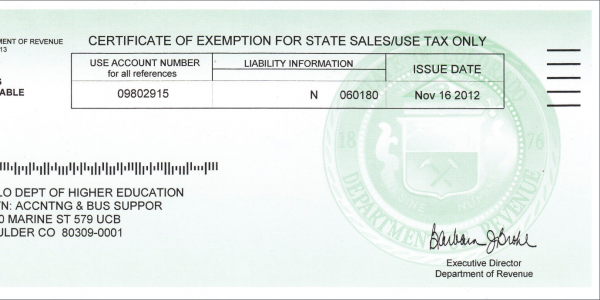

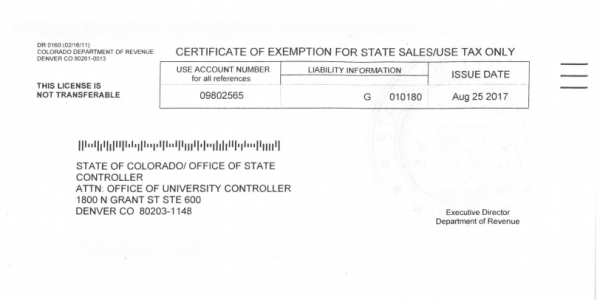

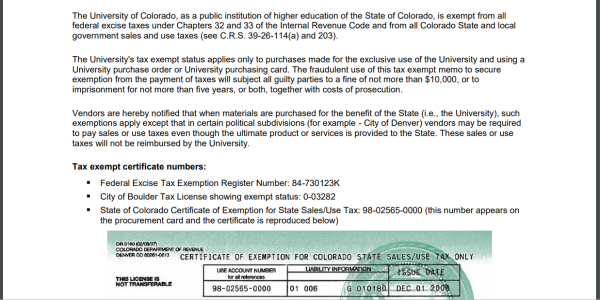

Sales Tax Campus Controller S Office University Of Colorado Boulder

All properties in Great Britain not Northern Ireland as well explain in a moment are divided into different value bands AH in England and Scotland.

. The Coronavirus Aid Relief and Economic Security Act includes several temporary tax law changes to help charities. We are open from 700 am. If you answered yes to any of the above questions and you do not already have a Business Tax Certificate for the activities mentioned above you should contact the City of Fresno Finance Departments Business Tax staff as soon as possible.

If you have your V5C reference number to hand you can also get tax rates and other information. Or Designated or Generic Exemption Certificate ST-28 Tax Exempt Entity Name. For example if you bought some new pots and pans in your luggage the dollar threshold would be applied to those items but not your clothes medications etc.

When you file as exempt from withholding with your employer for federal tax withholding you dont make any federal income tax payments during the year. Other taxes and fees have different rates based on the tax or fee. This 300 deduction is designed for taxpayers who take the standard deduction and arent normally able to deduct their donations.

We are open Monday through Friday beginning at 6 am. If you need an additional or replacement copy you can print one through your Business Online Services Account. It asks for basic.

This includes the special. You can also get a copy by calling Customer Services at 8043678037. To apply for tax-exempt status you must complete IRS Form 1023.

The Business Specialty Tax Line at 800-829-4933 can help you find your EIN. How Do I Look Up An EIN Number In Illinois. Use a private third party.

So you should. Meaning that you can bring additional items with you. You can replace your missing paperwork quickly online.

The records on file include items such as the date of establishment registered agent address and often the EIN. Itll tell you when your tax is due for renewal as well as when your MOT is up. COVID Tax Tip 2020-170 December 14 2020 Following tax law changes cash donations of up to 300 made this year by December 31 2020 are now deductible without having to itemize when people file their taxes in 2021.

How to tax a car without V5. The thing about sellers permit. Now lets take a look at Form 1023 Application for Recognition of Exemption Under Section 501c3 of the Internal Revenue Code.

However people who previously took the ACTC likely wont need it for 2021 taxes because the 2021 child tax credit is. Youll need to know the IRS exemption policy examine your tax deductions and general tax situation and review potential penalties you could face. The Business Tax Division is located on the ground floor of City Hall.

If you are filing exempt for tax purposes you will need to indicate as such on the Internal Revenue Service IRS Form W-4 which will estimate the amount that should be withheld from your paycheck depending on certain tax information that you provide. I certify that I am on official federal government business and the purpose. If you want to sell online temporarily you can get a temporary sellers permit.

Other Taxes and Fees. If you try to sell the property you may have to pay off the judgment lien before receiving any of the sale proceeds. The major steps are getting a sellers permit understanding and staying on top of the local tax rate and filing the tax returns with the state or taxing entity.

Using her newfound legal knowledge she obtained 501c3 tax-exempt status and grew her nonprofit into an organization that has served 1689 students and has awarded 34 college scholarships. Once you know where you stand in the sales tax picture its time to figure out how you go about collecting state and local sales taxes and how to get the collected money to the proper place. You can look up a tax rate by address or look up tax rates by city and county.

Sales Tax Certificates Form ST-4 Your certificate must be displayed prominently at your registered location. This section tells the IRS about your organization. Instead you can give your supplier a resale certificate when you buy products that you either wholesale or retail in your online store.

Council tax charges are made per household rather than per person and are calculated by the value of the property youre living in. A taxpayer is still subject to FICA tax And without paying tax throughout the year you wont qualify for a tax refund unless you qualify to claim a refundable tax credit. In the latest post on A Closer Look Tax Exempt and Government Entities Commissioner Edward Killen reminds taxpayers theres a special deduction for cash donations of up to 300 to a qualified charity in 2020.

The additional child tax credit can be taken in addition to the CTC and it just allows you to receive a refund if the CTC brings your tax liability the total income tax you owe for the year below 0. Businesses complete the certificate and provide it to the vendor. If youre planning on filing exempt on taxes for 6 months or an even longer time you might wonder how you can best prepare for a larger tax bill.

Box or Rural Route City State ZIP Code. However even if you only made 10 in the prior year you cannot claim an exemption on your federal tax. You can look up a business by the legal name fictitious name or individual owner name.

As a result Revolution Leadership receives major grants from Wells Fargo Enterprise as well as corporate sponsorships from Wal-mart Olive Garden and. If you find it too. The homestead exemption in your state impacts just what this would look like for you.

As you are simply acting as a tax collector for HMRC the idea is that you pay as much as you collect or reclaim the difference and ultimately break even. The vendor keeps the certificate and makes a sale without tax. _____Expiration Date_____ _____ _____ oFederal Exemption from Kansas Sales Tax.

For-profit third-party companies exist to help you locate and verify information on a business. Share per value refers to the stated minimum value and generally doesnt correspond to the actual share value. The refund for the ACTC in this situation is up to 1400.

For more information on how to determine your sales and use tax rates please see California City County Sales Use Tax Rates. You can talk live to tax experts online for unlimited answers and advice OR have a dedicated tax expert do your taxes for you so you can be. In the same way workers who are employed in the United States pay only US.

Registered agents are responsible for receiving all legal and tax documentation on behalf of the corporation. Council tax is a yearly charge paid in 10 or 12 monthly instalments throughout the year. If you dont have an account enroll here.

Those items are exempt from duty and dont count toward the dollar thresholds. They last up to 90 days. To view notices of tax rate changes please go to Special Notices on our website.

Clarification needed is the person who prepares and files the Certificate of Incorporation with the concerned state. Kansas Exempt Organization ID Number. These certificates are issued by the New York State Department of Taxation and Finance DTF.

If a creditor records a certificate of judgment in the county records office it can create a judgment lien. If you cant directly ask the day care provider. In reality the value of a share is based.

Form 1023 is divided into 11 parts and is covered in more detail below. Businesses can apply for certificates that exempt them from paying sales tax on certain items. Security tax and you are exempt from foreign tax.

On the other hand if you were hired in one of the listed agreement countries or sent to that country for more than five years you generally will pay social security taxes only to that country and will be exempt from paying US. Late compliance may result in penalty fees. As we will explore in detail in the next section if your business only sells VAT exempt goods or services then you cannot register your business for VAT because you are a VAT exempt business.

If you havent got your V5 or V5C as its also known dont worry. What About Personal Property.

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

Tax Exemption Form Free Tax Exempt Certificate Template Formswift

Sales Tax Campus Controller S Office University Of Colorado Boulder